|

梁婉蘭(加拿大) Christina Leung Z-828268 (1) 6472981234 請同代理講聲喺360睇到此樓盤,多謝支持! |

| 實用面積 S.A.(sq.ft.): | |||

| 住宅物業介紹 Residential Introduction: | |||

|

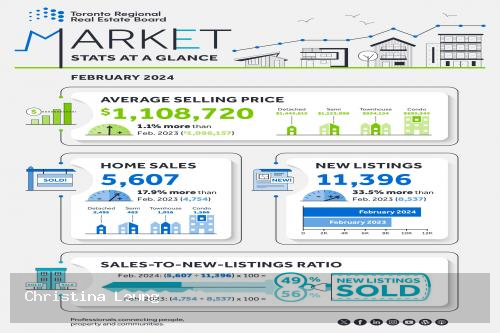

NO: 016360-23001/2024-10-07 07:33:50 Buyers Re-Enter the GTA Housing Market in February /5% Interest Rate Again TORONTO REGIONAL REAL ESTATE REPORT DATED ON 5 MARCH 2024 Home sales and new listings were up on annual and monthly basis in February 2024. The consumers are now anticipating the rate cuts this year. The average selling price remains nearly flat at around $1.1M compared to the same time last year. Some bidding wars are failing. Bank of Canada holds key interest rate at 5% again on 6 Mar 2024 REALTORS® reported 5,607 GTA home sales through TRREB’s MLS® System in February 2024 – an increase of 17.9 per cent compared to February 2023. Accounting for the leap year effect, sales were actually up 12.3% year-over-year. Home selling prices in February 2024 remained similar to February 2023. The average selling price of $1,108,720 increased by a modest 1.1 per cent. On a seasonally adjusted monthly basis, both the MLS® HPI Composite and the average selling price edged upward. “We have recently seen a resurgence in sales activity compared to last year. The market assumption is that the Bank of Canada has finished hiking rates. Consumers are now anticipating rate cuts in the near future. A growing number of homebuyers have also come to terms with elevated mortgage rates over the past two years. To minimize higher monthly payments, some buyers have likely saved up a larger down payment, chosen to purchase a less-expensive home type and/or looked to a different location in the GTA,” said TRREB President Jennifer Pearce. “As we move through 2024, an increasing number of buyers will re-enter the market with adjusted housing preferences to account for higher borrowing costs. In the second half of the year, lower interest rates will further boost demand for ownership housing. First-time buying activity will also be a contributing factor, as many renters look to trade high monthly rents for a long-term investment in which they can live and build equity,” said TRREB Chief Market Analyst Jason Mercer. Home sales spike higher across the GTA, but average prices haven't budged. Toronto's detached homes saw a 20% price drop since the pandemic peak - is a comeback on the way?

|

|||